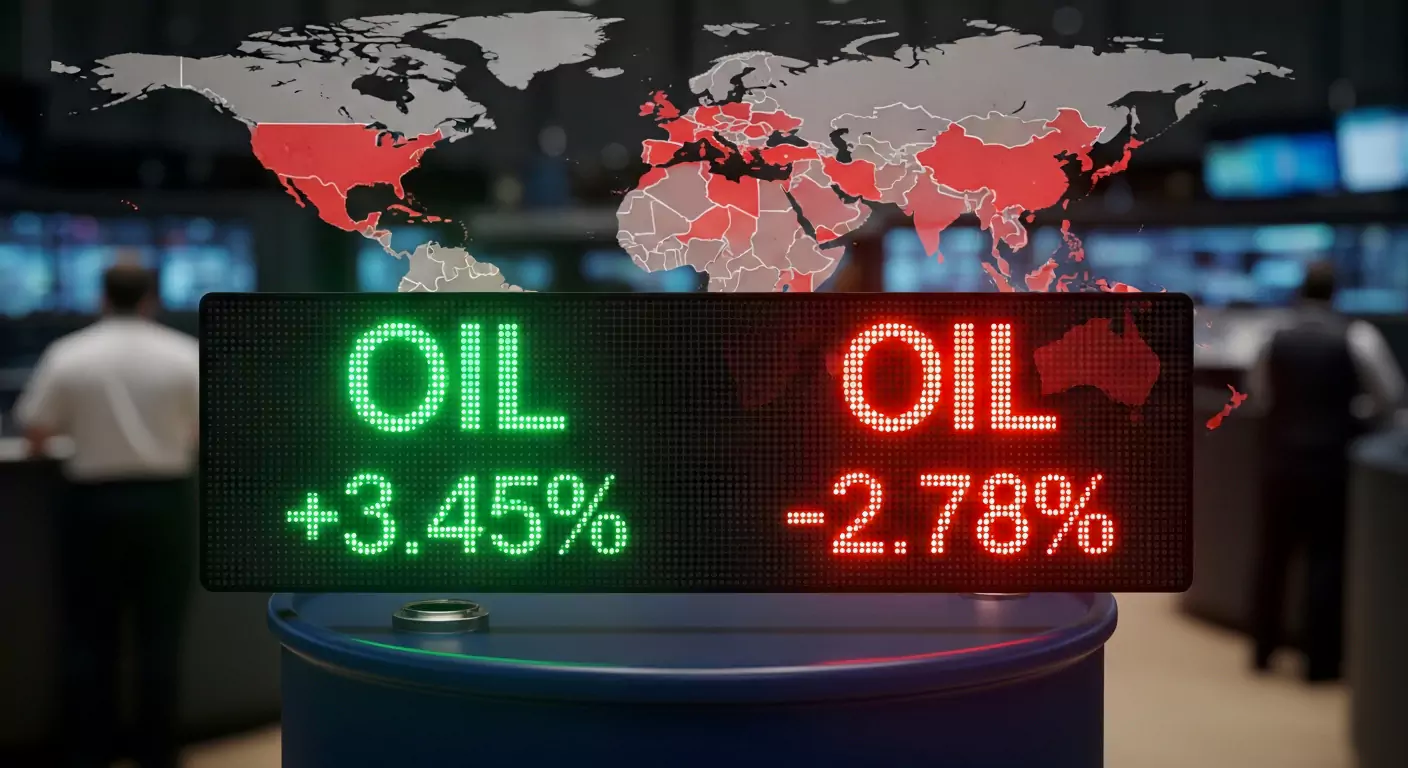

Global Oil Markets See Fresh Volatility

Global crude oil prices are witnessing sharp fluctuations as geopolitical tensions intensify in key energy-producing regions. Concerns over supply disruptions, shipping risks, and diplomatic conflicts have triggered uncertainty in international markets.

Benchmark crude contracts such as Brent Crude and West Texas Intermediate have shown volatile trading patterns, reflecting investor caution and speculative movements.

What Is Driving the Fluctuation?

Several factors are contributing to the instability in oil prices:

1️⃣ Geopolitical Conflicts

Tensions in major oil-producing regions often raise fears of supply cuts or transportation disruptions. Even the possibility of sanctions or military escalation can cause immediate price spikes.

2️⃣ OPEC+ Production Decisions

The oil market is heavily influenced by output decisions taken by OPEC+. Production cuts or extensions can tighten supply, pushing prices upward.

3️⃣ Shipping & Trade Route Risks

Strategic waterways play a crucial role in global oil transport. Any threat to routes like the Strait of Hormuz can create panic in energy markets.

4️⃣ Currency & Economic Signals

A stronger US dollar typically pressures oil prices, while global economic slowdown fears can reduce demand projections.

Impact on India

India, being one of the world’s largest crude oil importers, is directly affected by global price movements. Rising crude prices can lead to:

- Increased petrol and diesel prices

- Higher transportation costs

- Inflationary pressure on goods and services

- Strain on government subsidies

Cities like Nagpur often see retail fuel prices respond to global crude trends, though taxation and local factors also influence final rates.

Market Reaction

Global stock markets tend to react sharply when oil prices swing unpredictably. Energy stocks may rise during price surges, while aviation and transportation sectors often face pressure due to higher fuel costs.

Investors closely monitor:

- Inventory data

- Production announcements

- Diplomatic developments

- Central bank policies

Will Oil Prices Stabilize?

Market analysts suggest that oil prices may remain volatile until geopolitical tensions ease and supply-demand dynamics become clearer. Seasonal demand changes and policy decisions will also influence future movements.

If conflicts escalate or production cuts deepen, prices could spike further. However, if diplomatic solutions emerge, markets may stabilize gradually.

What Consumers Should Expect

For consumers, fluctuating oil prices may translate into:

- Possible changes in daily fuel rates

- Impact on transportation fares

- Increased cost of essentials

Monitoring global crude trends becomes important for understanding local fuel price behavior.

Conclusion

Oil prices remain highly sensitive to geopolitical developments. As global tensions continue to influence supply chains and market sentiment, volatility may persist in the short term. Governments, investors, and consumers alike are watching developments closely.